Why Demand for In-store Contactless Payments is Here To Stay?

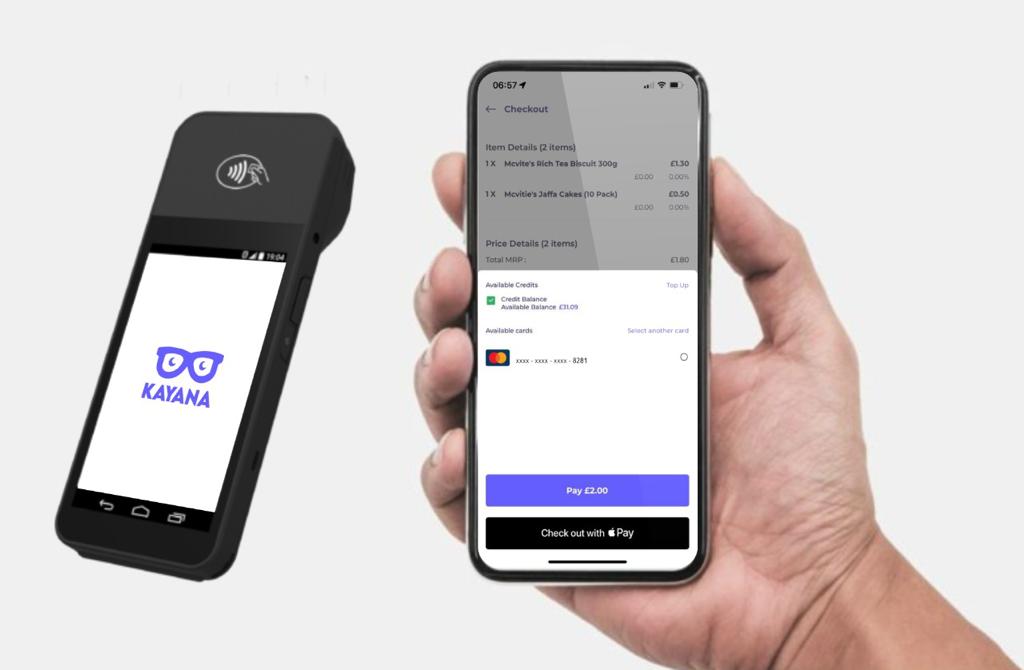

Whether they are tapping a physical card to pay, using a digital wallet on their smartphone or watch, or paying with a QR code, the way people pay in stores is moving in one direction: contactless. Are you following them?

Consumers prefer low- or no-touch engagements, and as a result of COVID-19, the adoption of contactless payment technologies has accelerated rapidly. This is the case despite its slow start. Contactless cards, kiosk payments, and QR codes are growing more popular for a safer shopping experience, while digital wallets are becoming the mainstay of in-store payment options. Many stores have come to embrace the in-store contactless payment systems.

According to Visa’s Back to Firm Study, 63 per cent of consumers said they would switch to a business that offered contactless payment choices. While health and safety concerns were the key factors driving 2020’s swift shift, contactless payments were already gaining appeal for three simple reasons: speed, convenience, and security.

In-store contactless payment systems are projected to replace the conventional payments systems that we are used to. This article explains why this new technology might stick with us longer than we had anticipated. Add self-service and contactless payments you have the perfect solution.

Business benefits from contactless payments

There are several benefits associated with contactless payments.

The primary advantage of taking contactless payments for both businesses and consumers is that it is significantly faster than any other in-person payment method. Customers can save time at the checkout counter by simply tapping to pay. In addition, a faster-moving line allows firms to process more transactions in the same amount of time. Contactless payments are a win-win situation on both sides of the transaction. It saves time.

Furthermore, contactless purchases are safer. The customer’s account data is tokenised into a one-time code and transmitted from a card or mobile device to the contactless scanner at the point of sale during a contactless payment transaction. Contactless transactions are safer than traditional swipe-to-pay transactions because card data are never revealed. With the growing security concerns worldwide, many people are opting for contactless payments.

Consumers want contactless

The digital-native generations of today have no qualms about testing out the latest technological advancements. Millennials and Gen Z’s payment habits, in particular, indicate the future of contactless payments. According to a global study performed by Mastercard, more than half of millennial and Gen Z shoppers will skip purchasing at stores that do not accept contactless payments at the point of sale. Even baby boomers have converted to contactless, with their preference for the technology increasing from 45 per cent before the epidemic to 55 per cent today. It is true to say that the pandemic affected or changed the shopping habits of many people.

Issuers and banks have been rolling out contactless cards for years, recognising this notable shift in preference across generations. According to a survey from A.T. Kearney, approximately 60% of credit and debit cards in the UK were contactless in 2018, 96 per cent in South Korea, and only about 3.5 per cent in the US. Demand from consumers and competition from digital wallets (such as Apple Pay, Alipay, and others) have helped to decrease the contactless card availability gap among regions.

Contactless payments are accepted all around the world

While it is critical for both issuers and merchants to adapt to the growing global popularity of contactless payments, contactless adoption and usage levels vary significantly among regions and countries. Below is a brief description of how people embrace contactless payments around the world.

Asia Pacific

In the Asia Pacific, according to a 2020 Mastercard research, 91 per cent of consumers use tap-to-pay, with 75 per cent intending to continue using it after the pandemic. The usage of QR codes is also gaining traction in the region, with 71 per cent of consumers believing they are more convenient for in-person payments—thanks to the widespread availability of mobile devices.

Digital wallets, on the other hand, are the most popular type of online payment mechanism in the Asia Pacific, accounting for 46% of the market. China has led the way in terms of adoption and usage, with digital wallets like Alipay and WeChat Pay accounting for 56 per cent of all online payments.

North America

Credit and debit cards are still the most popular payment methods in North America, with 59 per cent of customers using them online. Digital wallets, on the other hand, are a distant second with a market share of only 23%.

According to Payments Canada, 56 per cent of Canadian consumers touch their physical card to make payments on a regular basis. In the United States, 51% of consumers now use contactless payments, which are often made with a contactless card or a digital wallet.

These numbers are projected to grow even further.

Europe and the United Kingdom

Individual European countries’ preferred payment methods vary greatly, but digital wallets are a popular online choice, with a 21 per cent market share in Western Europe and a 25 per cent market share in the United Kingdom.

Contactless payments accounted for 88.6 per cent of total card transactions in the United Kingdom in 2020. While contactless cards have been in use since 2007, the rise in the contactless limit from £30 to £45 in April 2020, with a projected increase to £100 in late 2021, is likely to have boosted usage.

COVID-19 has accelerated the adoption of contactless payments, reducing the time it takes to go from a three- to five-year growth trend to less than a year. While consumers may prioritise security when choosing tap-to-pay now, contactless payment’s speed and security will ensure it stays a dominating payment method in the future.

The future is touchless

Experts agree that any investment now becomes a long-term bet with contactless payments. In the end, these touchless choices will go well beyond just technology-enabled plastic. According to industry leaders, fast-food drive-through windows, for example, where payment is made as seamlessly as a toll payment using technology implanted in the automobile.